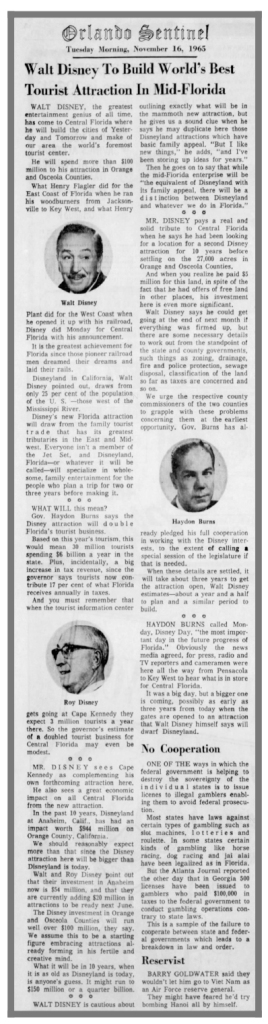

In the span of 72 hours, the Florida legislature introduced, passed and signed a bill stripping Disney’s hometown, the Reedy Creek Improvement District, of its status as a special tax district.

The bill goes into effect in June 2023 and ends Disney’s self-governing status, which allows the company to manage all municipal matters in the 25,000-acre district surrounding the Walt Disney World Resort, such as sewage, transportation, zoning and security.

It’s widely believed that Gov. Ron DeSantis made the move in retaliation for Disney’s opposition to Florida’s “Don’t Say Gay” bill, which passed in March. Disney had initially been quiet about the bill, aimed at curbing sex education in lower elementary grades, but proclaimed its opposition after employees staged a walk-out once the bill had already passed.

While the move to end Disney’s special status has political implications that reverberate far beyond Florida, it also leaves some very practical questions unanswered. For one, with Disney’s status dissolved, its property, duties and debt all transfer to the two counties in which it is located, Orange and Osceola counties, without adding any additional tax revenue — potentially leaving the residents of those counties with an overwhelming tax bomb.

Reedy Creek is an independent special tax district, which means it must pay taxes to the county government in addition to paying itself to run the town. Between 2015 and 2020, Disney paid an average of $45 million in property taxes to Orange and Osceola counties, and in 2021, it paid itself $105 million for local services, according to Scott Randolph, tax collector in Orange County. Once Reedy Creek is dissolved, the $105 million doesn’t transfer, but the counties will be responsible for all municipal services.

Continue reading